- Murrieta Mesa High

- Financial Aid

College/Career Center

Page Navigation

- Welcome Rams!

- Career Information Links

- College Fairs (Virtual) and Information Sessions

- College Information

- College Presentation Calendar

- College Search Tool

- COVID-19 Related Concerns to College Admissions

- Financial Aid

- Reminder to all Male Seniors!

- Scholarships

- Transcript Requests

- UC Preview Days

- Work Permits

-

What is Financial Aid?

- Financial aid is money to help pay for college or career school. Examples of financial aid grants, work-study, loans, and scholarships help make college or career school affordable.

How do I apply for federal aid?

Finding financial aid can seem overwhelming when you're trying to get ready for college or career school. It doesn't have to be! We'll walk you through how financial aid works, resources to pay for college, and loan repayment options.

- First Create a Free Federal Student Aid Account (Click Here)

- Get Prepared. Gather the documents you'll need;

- Social Security number (it’s important that you enter it correctly on the FAFSA form!)

- Your parents’ Social Security numbers (if you are a dependent student)

- Your driver’s license number if you have one.- Complete FAFSA® Form. Apply early to maximize your aid. (MARCH 2nd DEADLINE)

- Review Student Aid Report. Make corrections, if necessary.

- Respond to Aid Offer. Accept the aid you want.

- Receive Aid.

- Renew Your FAFSA® Form.

GRANTS (FREE MONEY)

- Pell Grant ranges from $200-$4050 and your eligibility is based upon your family's financial circumstances. Part time students are eligible for Pell Grants, but their award is reduced accordingly. Students must have a social security number to complete this form. Pell Grants can be used at colleges, vocational, technical, business schools, and hospital schools of nursing.

Federal Supplemental Educational Opportunity Grant (FSEOG) is a grant for undergraduate students with exceptional financial need.

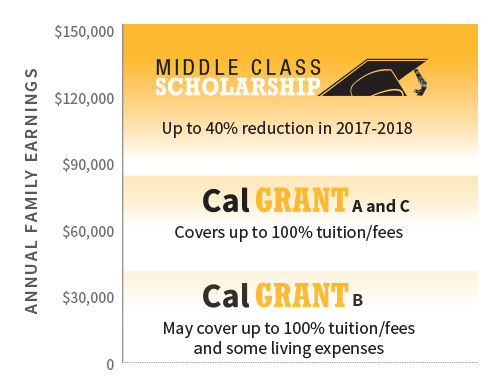

Cal Grant is a California-specific financial aid allocation that does not need to be paid back. (There are three kinds of Cal Grants A, B and C)

- To qualify for cal grant A, B, or C a student must:

- Be California Resident Attending a Eligible College or University in the State

- Be Making Satisfactory Academic Progress as Determined by the College or University

- Be in a Program Leading to a Certificate or College Degree

- Not Poses a B.A. Prior to Receiving a Cal Grant

- Have a Valid Social Security Number

- Have a 2.0 Grade Point Average

- Meet financial guidelines as outlinedCal Grant A

- This grant assist low and middle income students with tuition and fee costs. Recipients are selected on the basis of financial need and G.P.A. The minimum GPA based on four semesters - two from sophomore year and two from junior year is a 3.0. The assistance ranges up to $5472 at a CSU, $12,192 at a UC and up to $9,084 at an independent California College or University. The FAFSA must be completed by March 2 to qualify. MMHS will electronically send GPA verification forms to the California Student Aid Commission provided we have the student's SS#.Cal Grant B

- This grant provides a living allowance(some tuition and fee assistance) to very low income students. This award ranges up to 1,473 dollars for the freshman year for books and living expenses. After the freshman year, Cal Grant B also helps pay tuition and fees in the same amount as a Cal Grant A. The FAFSA must be completed by March 2 to qualify. MMHS will electronically send GPA verification forms to the California Student Aid Commission provided we have the student's SS#.Cal Grant C

- This grant assists vocational students with their tuition and training costs. Students must be enrolled in a vocational program at a community college, independent college, or a vocational school in a program of study from four to twenty-four months of study in length. Awards range up to $2,462 for tuition and fees; and up to $547 dollars for books, tools, and equipment. A FAFSA form and GPA verification form are required.For More Info Click Here

- Middle Class Scholarship (MCS) is for undergraduates and students pursuing a teaching credential with family assets up to $184,000 and income up to $184,000.

- Students must meet the following requirements: be a California resident attending a UC or CSU; be a U.S. citizen, permanent resident or have AB 540* student status; meet certain income/asset and other financial aid standards; maintain satisfactory academic progress; not be in default on a student loan; and, must not be incarcerated.

- You may receive the MCS award for up to 4 years depending on education level when awarded

- Students whose families have income up to $184,000 and assets up to $184,000 per year may be eligible for a scholarship amount between 10% and 40% of the mandatory system-wide tuition and fees at a University of California or California State University campuses

- To learn click here

LOANS (MONEY THAT NEEDS TO BE PAID BACK)

- Federal Perkins Loan are low-interest federal student loans for undergraduate and graduate students with exceptional financial need.

- Direct Stafford Loans

- Direct Subsidized Loans are loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education at a college or career school.

- Direct Unsubsidized Loans are loans made to eligible undergraduate, graduate, and professional students, but eligibility is not based on financial need.

- Direct PLUS Loans are loans made to graduate or professional students and parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid. Eligibility is not based on financial need, but a credit check is required. Borrowers who have an adverse credit history must meet additional requirements to qualify.

- Direct Consolidation Loans allow you to combine all your eligible federal student loans into a single loan with a single loan servicer.

WORK-STUDY JOBS (EARNED MONEY)

- The work study program provides you with a job while attending college. Student's usually work a limited number of hours per week while college is in session and ensures that the job will not interfere with your academic program.

- Average earnings during the academic year would usually be 1,500-2,000 dollars.

Other Ways to Finance a College Education

Refer too Scholarship Page on the Counseling Sub Navigation Menu or Click Here

ROTC: Reserve Officer Training Core

The Military Branches have scholarship programs to help students who are interested in becoming officers in the service after graduation. Scholarships are awarded to college freshman based on their high school grades, SAT/ACT scores, activities at school or in the community. Scholarships are also awarded to college sophomores and juniors based on their performance in the ROTC program and grades in college. These scholarships pay for tuition, fees, books, and laboratory expenses. In addition scholarship holders receive 100 dollars per month for ten months during the school year.

Military Loan Repayment

The department of defense provides 65,000 dollars in loans to be repaid for individual students who qualify. Check with your local military recruiter for more information.